Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements. Or b imported into Malaysia by any person.

The Resurrection Of Sales And Service Tax Sales Taxes Vat Gst Malaysia

SST is governed by two 2 separate laws which are Sales Tax Act 2018 and Service Tax Act 2018.

. SST consist of 2 separate act. SCOPE CHARGE Sales tax is not charged on. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

The Sales Tax is a single-stage tax charged and levied on taxable goods imported into Malaysia and on taxable goods manufactured in Malaysia by a taxable person and sold by him including used or disposed of goods. On 1 June 2018 GST was set at zero by the Malaysian government. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018.

Secondment of employees or supplying employees to work for another person for a period of time. The Royal Malaysian Customs Department RMCDadministers this type of tax. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019.

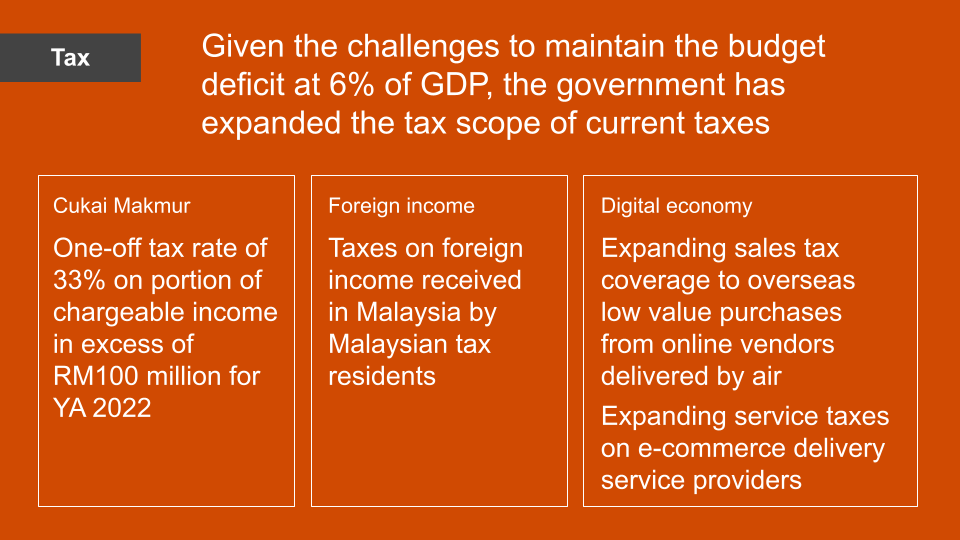

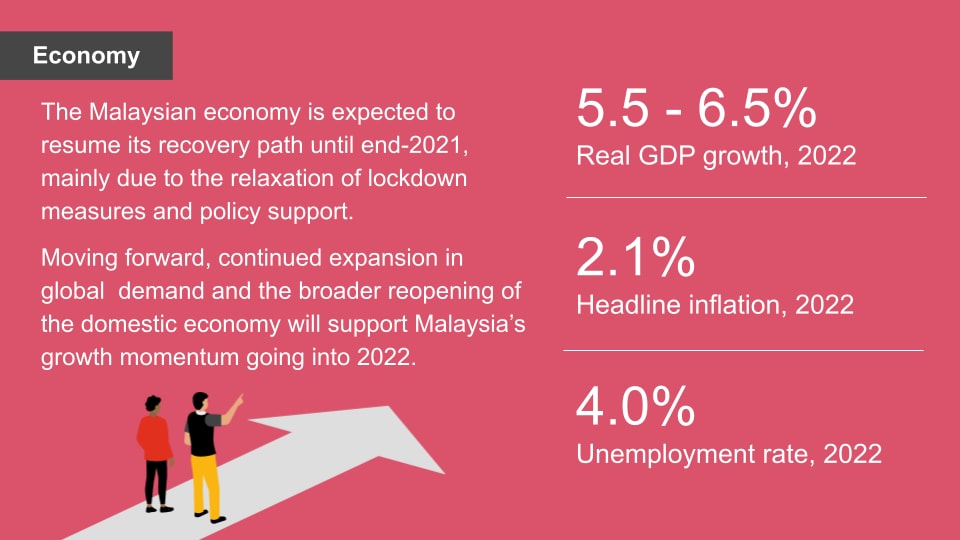

According to our econometric models the Malaysian Sales and Services Tax SST is expected to have a long-term trend of roughly 1000 percent in 2022. It was previously known with different identity. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia.

It took the place of the 6 percent consumption tax levied by the Goods and Services Tax GST which was stopped on June 1 2018. Kerajaan mengalami kerugian kira-kira RM20 bilion ketika peralihan cukai barang dan perkhidmatan GST kepada cukai jualan dan perkhidmatan SST pada 2018 yang diperlukan untuk menampung jurang fiskal yang ditinggalkan oleh subsidi lebih tinggi dan meneruskan penyatuan fiskal. A 6 rate has been fixed for SST by the Ministry of Finance on 1st September 2018.

Non-compliance will result in reassessment of tax plus hefty. Employment outside Malaysia RM500000 20. Sales Tax Regulations Sales Tax Regulations 2018.

The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is based on inclusion criteria meaning. This is later on replaced by the re-introduced Tax. This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner.

The above Acts has numerous Standard Operating Procedures which need to be complied with. SST is administered by the Royal Malaysian Customs Department RMCD. What is the current SST in Malaysia.

The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question. Sales Tax Act and Service Tax Act. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018.

The Royal Malaysian Customs Department has reintroduced Sales and Service Tax SST with effect from 1 September 2018. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. In Malaysia Sales and Service TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

Land outside Malaysia or where the subject matter relates to a country outside Malaysia RM500000 19. Jabatan Kastam Diraja Malaysia. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

Penganalisis CGS-CIMB Research Nazmi Idrus berkata. Amendment 12019 Sales Tax Determination Of Sale Value Of Taxable Goods Regulations 2018. Employment agency RM150000 Employment agency Employment services excluding 1.

A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. It is replacing the 6 Goods and Services Tax suspended on 1 June 2018. Here are the details on how the SST works - the registration process returns and payment of the SST and the transitional measures to take after the abolishment of the GST.

List Of SST Regulations. 2 days agoKUALA LUMPUR. Exempted from SST registration are tailoring jewellers and opticians.

Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. This sales and tax service is governed by the Royal Malaysian Customs Department RMCD. It was replaced by a more robust and people-friendly tax collection system on 1 September 2018 which is referred to as the sales and service tax SST.

Malaysias indirect sales tax SST was reinstated on September 1 2018 replacing the previous sales and service tax SST. Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018. I The SST will be a single-stage tax where the sales ad.

The switch is expected to cost the country an estimated at RM25 billion in lost revenues as only a fraction of the companies. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. When did Malaysia get SST.

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Service tax a consumption tax levied and. On September 1 2018 it was phased out and replaced with a sales and services tax SST.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat. GST was only introduced in April 2015. Service Tax Regulations Service Tax Regulations 2018.

Which is GST or Goods and Service Tax introduced and implemented in 2015.

Goods And Person Exempted From Sales Tax Sst Malaysia

J T Express Price List Rates Charges Peninsular Sabah Sarawak Price List Klang Sabah

Subaru Price Protection Scheme Lower Sum Applies For Bookings If Gst To Sst Move Increases Car Prices Paultan Org

![]()

Volvo Car Malaysia Prices With Sst

Department Of Statistics Malaysia Official Portal

Sst Mazda Price List 17 Models Now Cheaper Including All In Cx 3 Cx 5 Mazda2 And Mazda3 Range Highwaytale Com

Cuckoo Malaysia Promotion Cuckoo Goood Plan 0 Sst Cuckoo How To Plan Promotion

Autocount Accounting Software Malaysia Financial Budget Budgeting Business

The Resurrection Of Sales And Service Tax Sales Taxes Vat Gst Malaysia

Sales Service Tax Sst In Malaysia Acclime Malaysia

Cross Border Shipping Or Local Distribution Logistics For Health And Beauty Products Into Malaysia Janio

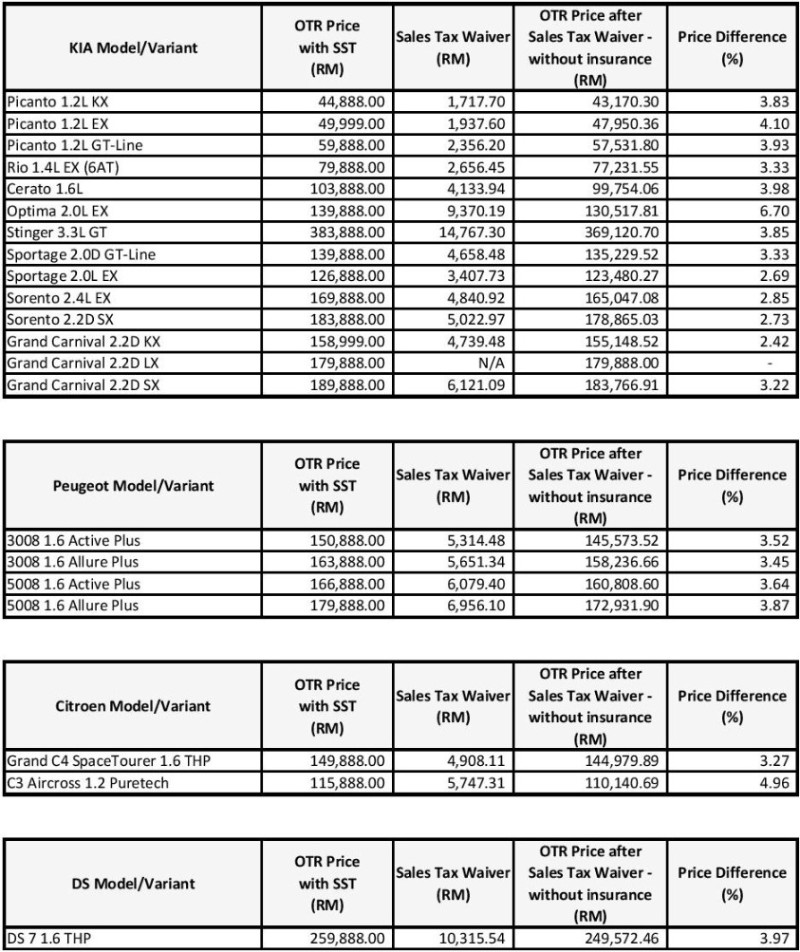

New Revised Price List For Kia Peugeot Citroen And Ds Wapcar

Motoring Malaysia Sst Prices For Bmw Cars Motorrad Mini In Malaysia Have Been Released Ckd Prices Mostly Goes Down With Cbu Prices Mostly Up

Post Sst Volkswagen Malaysia Reduce Prices For Ckd Models Autobuzz My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0